India is the fastest growing e-commerce in the world

Data from IBEF and DPIIT

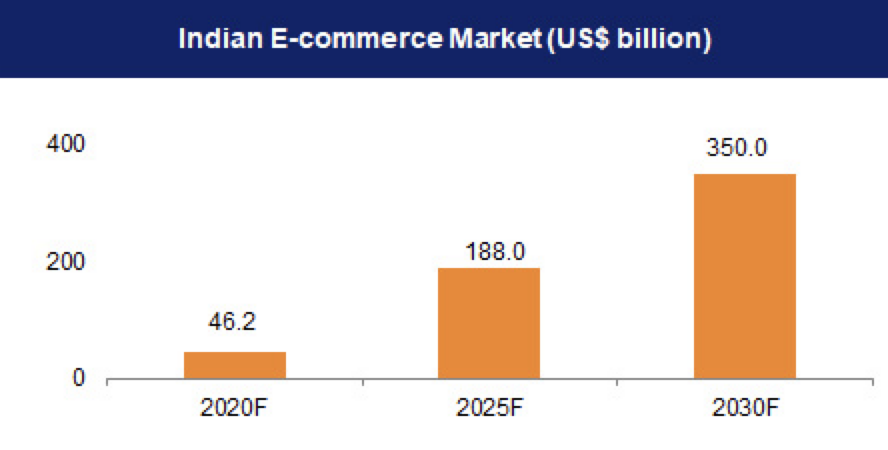

Out of the total internet connections, ~55% of connections were in urban areas, of which 97% of connections were wireless.smartphone base has also increased significantly and is expected to reach 1.1 billion by 2025, and it is expected to reach US$ 1 trillion by 2030. Major segments such as D2C and B2B have experienced immense growth in recent years. India’s D2C market is expected to reach US$ 60 billion by FY27. The overall e-commerce market is also expected to reach US$ 350 billion by 2030 and will experience 21.5% growth in 2022 and reach US$ 74.8 billion.

In FY23, the Gross Merchandise Value (GMV) of e-commerce reached US$ 60 billion, increasing 22% over the previous year. In FY22, the GMV of e-commerce stood at US$ 49 billion.India's Business-to-Business (B2B) online marketplace would be a US$ 200 billion opportunity by 2030.With over 821 million users, India was the second-largest internet market in the world with 117.6 billion UPI transactions in 2023.The e-commerce market’s share of Tier-3 cities grew from 34.2% in 2021 to 41.5% in 2022, shows data. After China and the US, India had the third-largest online shopper base of 150 million in FY21 and is expected to be 350 million by FY26.

Data by Invest India, DPIIT

The Indian e-commerce industry has been on an upward growth trajectory. In FY 2022-23, Government e-marketplace (GeM) registered its highest ever Gross Merchandise Value of $2011 Bn. GeM has achieved a cumulative GMV of more than 5.93 Lakh Cr (since inception). Hence, considering the saving estimates as reported above, GeM has facilitated savings worth more than INR 40,000 Cr since its inception. As per TRAI’s Indian Telecom Services Performance Indicators Jul-Sept 2023, the internet penetration in India as of Sept 2023, is over 918.19 Mn, and the number of telecom subscribers as of Apr 2024 is over 1201 Mn.The e-commerce industry in India is growing on levers such as increased smartphone penetration, increased affluence and low data prices, providing impetus for e-retail growth. With over 900 Mn users, India is the 2nd largest internet market in the world with 131.16 Lakh Cr UPI transactions in FY 2023-24.Close to 100% of pin codes in India have seen e-commerce adoption. More than 60% of transactions and orders in India come from tier two cities and smaller towns. The e-commerce trend is gaining major popularity even in tier-2 and tier– 3 cities as they now make up nearly half of all shoppers and contribute three of every five orders for leading e-retail platforms. The average selling price (ASP) in tier-2 and smaller towns is only marginally lower than in tier-1/metro cities. Electronics and apparel make up nearly 70% of the e-commerce market, when evaluated against transaction value. Other new upcoming categories within e-commerce include ed-tech, hyperlocal and food-tech.ONDC, a network launched by the Government of India in 2022, aims to provide equal opportunities to MSMEs to thrive in digital commerce and democratize e-commerce. In 2022, Indian e-commerce and consumer internet companies raised $15.4 Bn in PE/VC funding, 2x increase from $8.2 Bn in 2020.